child tax credit october 2021 date

THE DEADLINE to opt-out of the child tax credit for November is approaching and those who dont want to receive the next child tax credit have until November 1 2021 at 1159pm to decline it. 29 What happens with the child tax credit payments after December.

Don T Overlook These Essential Small Business Tax Credits Small Business Tax Business Tax Tax Credits

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

. 15 opt out by Nov. File a federal return to claim your child tax credit. If you dont receive all of the advanced payments you will claim the rest of the credit on your tax return.

Pay dates for the rest of the child tax credit checks. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. IR-2021-201 October 15 2021.

Each payment is made on the 15th of the month. To be eligible for the maximum credit taxpayers had to have an AGI of. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are scheduled to arrive Oct. October Payments Hitting Parents Bank Accounts October 15 2021 1242 PM CBS DFW CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

15 by direct deposit and through the mail. Includes related provincial and territorial programs. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

October 15 2021 is the next payment date. 13 opt out by Aug. The credit increased from 2000 per.

If a taxpayer wont be claiming. Wait 5 working days from the payment date to contact us. Child Tax Credit.

The next payment goes out on Oct. Simple or complex always free. 15 opt out by Oct.

While the October payments of the Child Tax Program have been sent out many parents have said they did not. 112500 or less for heads of household. 15 opt out by Aug.

This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. 1052 AM PDT October 15 2021 The October installment of the advanced child tax credit payment is. 1201 ET Oct 20 2021.

15 opt out by Nov. December 13 2022 Havent received your payment. Most of us really arent thinking tax returns in mid-October.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. Goods and services tax harmonized sales tax GSTHST credit. 75000 or less for singles.

The Biden Administration is seeking to renew the enhanced CTC through. It also lets recipients unenroll from advance payments in favor of a one-time credit when filing their 2021 taxes. We explain the key deadlines for child tax credit in October Credit.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 947 ET Oct 21 2021. 15 is a date to watch for a few reasons.

The deadline for the next payment was October 4. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17. October 20 2022.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The Child Tax Credit is a fully refundable tax credit for families with qualifying children.

Child Tax Credit Will There Be Another Check In April 2022 Marca

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Dividends Why We Invest In Dividend Stocks And Etfs Dividend Investing In Canada Dividend Income Dividend Portfolio Dividend Dividend Investing Investing

Some Parents Won T Get Child Tax Credit Payments Unless They Sign Up By Oct 15 Here S Why Cnet

2021 Us Tax Deadlines Expat Us Tax

2022 Tax Deadlines And Extensions For Americans Abroad

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Corona Updates For Internationals In Germany Fintiba

The Iss Humanity S Largest Outpost In Space Dlr Portal

Child Tax Credit 2021 8 Things You Need To Know District Capital

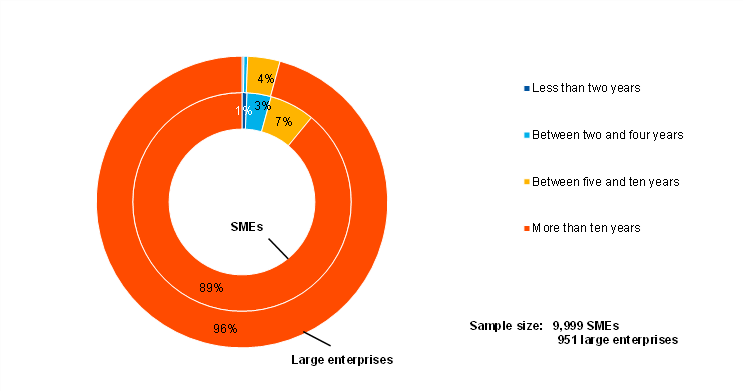

Survey On The Access To Finance Of Enterprises In The Euro Area October 2020 To March 2021

Scholastic Book Fair Book Fair Scholastic Book

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Equipment Leasing And Financing A Product Sales And Business Profit Center Strategy In 2022 Corporate Risk Management Profitable Business Risk Management